Homeowners are more price-conscious than ever—and that means roofing contractors need more than quality products and a great pitch to win the job. Customers want payment options that fit their budgets, especially for high-ticket repairs they didn’t plan for. That’s where roof financing comes in.

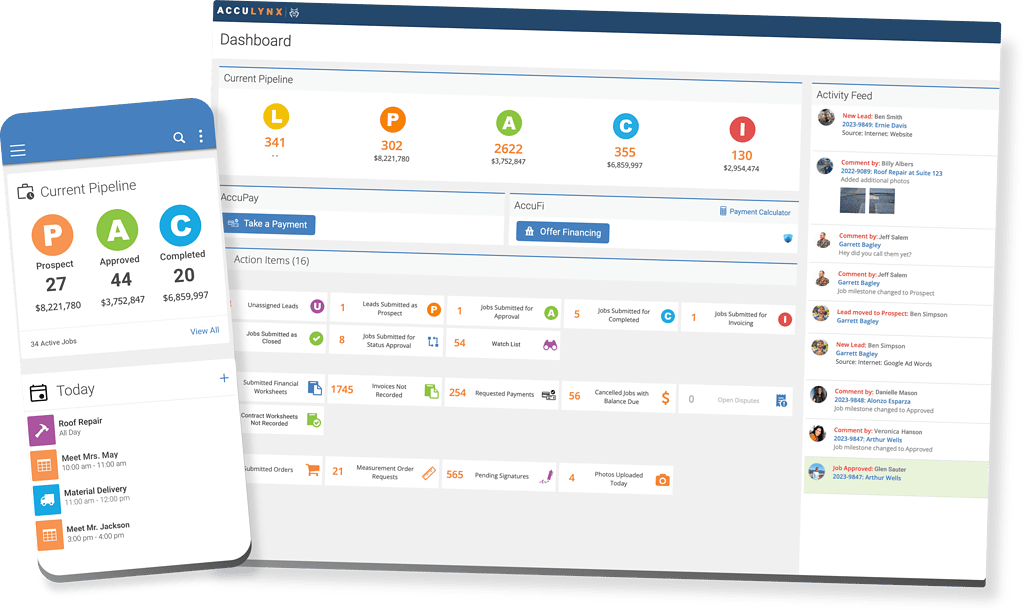

With integrated point-of-sale (POS) financing through AccuLynx, contractors can offer flexible payment options that help close more jobs, drive higher revenue, and keep customers happy—without ever leaving their roofing CRM.

Why roof financing matters more than ever for contractors

Almost 40% of Americans say they have less in emergency savings than they did a year ago. For homeowners facing an unexpected roof replacement, the lack of available funds can delay—or even derail—a much-needed project.

When contractors offer roof financing at the point of sale, they remove a major barrier to moving forward. Instead of walking away because of cost, homeowners can say “yes” to your estimate—and choose premium upgrades—with a monthly payment that works for them.

For roofing companies, this means more signed contracts, larger average job sizes, and a competitive edge over contractors who expect full payment upfront. It’s why roof financing has quickly become a must-have tool for contractors.

A simpler way to manage financing

That’s why AccuLynx includes AccuFi, our built-in financing tool powered by Acorn Finance. AccuFi lets you offer competitive homeowner financing and manage the entire process—from application to payout—directly from the job file. You’ll know if a loan is approved, when to expect payment, and whether any action is needed to move the project forward.

This level of visibility is what sets roof financing for contractors in AccuLynx apart. No more wondering when you’ll get paid or chasing down updates. Just faster projects and fewer delays.

Keep your cash flow moving

One of the biggest challenges with financing through outside providers is the lack of transparency. You might not know if a loan was approved, when funds will arrive, or if there’s a problem holding up payment. That uncertainty can lead to stalled schedules, missed revenue projections, and stress for your team.

With AccuFi, all financing updates live right inside the job file. You can track approvals, monitor progress, and build more accurate payment forecasts. It’s an easier way to stay on top of cash flow—and avoid the gaps that happen when payment lags behind project completion.

Plus, with AccuLynx’s payment tracking tools, you can map financing milestones to your revenue plan, giving you the data you need to make smart business decisions in real time.

Turn price objections into opportunities

Remember, financing isn’t just about affordability—it also enables upsell opportunities. With manageable monthly payments, customers feel more comfortable choosing premium products or additional services, driving higher revenue per project. The result? Higher margins, more satisfied homeowners, and better outcomes for your business.

But sometimes, even with great financing options, homeowners still hesitate. AccuLynx gives you the tools to keep those conversations going and move more prospects toward a “yes.”

You can create automations in AccuLynx like email or text follow-ups that highlight your roof financing for contractors program—without adding more work for your sales team. Use filters to identify leads that went cold and re-engage them with financing offers and updated estimates.

AccuLynx + roof financing = more wins

Roof financing is no longer a “nice to have”—it’s a smart strategy for any contractor looking to close more deals, grow revenue, and deliver better customer experiences.

With AccuFi, you get:

- Instant homeowner pre-approval

- Real-time loan status updates

- Embedded financing links in estimates

And because it’s all built into AccuLynx, it’s easy to offer financing without changing your workflow or jumping between platforms. Ready to see how roof financing for contractors—and the rest of AccuLynx—can help you win more jobs and grow faster?

3 Comments. Leave new

I am a contractor working on providing financing for my customers roofs.

How interesting to know that there are options for financing with your contractor. My roof was badly damaged in a big storm two days ago. I will find a good roofing contractor to assist with this locally.

For roofing contractors, the blog entry on Acculynx titled “Roof Financing for Contractors” contains useful information on the subject of financing choices. roofer Farmington CT The article looks at various financing options that contractors can use to give their clients flexible payment schedules. Contractors may easily understand the advantages and factors to be taken into account when implementing finance plans thanks to the comprehensive and well-organized information.