How to build and grow an insurance restoration roofing business

In this guide, we cover everything insurance restoration roofing contractors need to know about starting their business, including what the job entails, the keys to success, and tips that will help along the way.

Table of contents

What is insurance restoration roofing?

The job of an insurance restoration roofing contractor

How to get insurance restoration roofing leads

Insurance restoration sales tips for roofing contractors

Weather tracking apps for insurance restoration specialists

How to assess a roof for storm damage

How roofing contractors can work with insurance providers

How roofing contractors can master the insurance claims process

Roofing software designed for insurance restoration roofing contractors

What is insurance restoration roofing?

Insurance restoration roofing is the repair of roof damage covered by the homeowner’s insurance policy. The cost of the repair work is generally covered by the claim payout amount from the homeowner’s insurance company.

Unlike general roof replacement or retail work, insurance restoration roofing is highly reliant on weather events. Depending on the frequency of storms in your area, insurance restoration roofing can be a fast-paced business requiring more efficiency and organization.

The job of an insurance restoration roofing contractor

Roofing contractors that perform insurance restoration work must have an understanding of the process, including:

- How insurance claims work

- What type of roof damage to look for

- How to document roof damage

During periods of inclement weather, insurance restoration contractors are juggling many roofing jobs at once. Whether it’s rain, hail, wind, tornadoes, or hurricanes, roofers have to be ready to deal with an influx of work immediately following any weather event that could potentially cause damage to a roof.

What insurance restoration roofing contractors do

- Meet with the homeowner and perform an inspection of their roof, documenting any damage.

- Answer questions from the adjuster during the insurance inspection and make sure damage isn’t missed.

- Work with the insurance company after the claim is filed, responding to requests, questions, etc., quickly to keep the process moving forward.

- Work with the homeowner to finalize a contract for scope of work. In many cases, this agreement will cover the damages mentioned in the assessment for a repair or replacement. However, the homeowner may want more work done outside of what is covered by their insurance.

What insurance restoration roofing contractors don’t do

- Perform secondary inspection to create a claim report (done by insurance adjuster).

- Send the claim for covered work to the homeowner’s insurance company.

- Approve the claim for covered work. The claim is reviewed by the insurance company based on the adjuster’s report of damages (this process can take a long time).

- Finalize the total amount of damages and send the check to the homeowner for approved work. The insurance company does this, ending their involvement.

How to get insurance restoration roofing leads

Obtaining insurance restoration leads for your contracting business begins with identifying homes with storm damage to their roof. Roofing contractors can find potential customers by:

“Canvassing” affected neighborhoods after a storm

- Go door-to-door and meet with homeowners that have been affected by recent storms

- Inspect the roof of homes with suspected damage

- Perform individual roof damage assessments

Marketing to your service areas or areas often affected by storms before and after inclement weather events:

Before:

- Have an up-to-date online presence with accurate contact information to be found through Google search. You should also have a form that is easy to fill out to inquire for services.

- List your business with websites like Angi Leads (formerly HomeAdvisor) and Yelp.

- Have active social media accounts.

After:

- Send personalized insurance restoration materials to homeowners affected by a storm.

- Continue to be active on social media and let your areas of service know how you can help.

- If the homeowner allows, place a company yard sign in their lawn to attract business. Word of mouth can be highly beneficial.

Insurance restoration sales tips for roofing contractors

Sales tip #1: Make the most of your “off” season

Erratic weather patterns can leave you without work for weeks. You’ll want to utilize the time in between storms to work on ensuring your processes are efficient and thorough, and provide additional training to your team.

Sales tip #2: Always have a plan in place

In order to take advantage of storms as they come, it’s essential to plan ahead and prepare your roofing business for storm season. Have your teams in place, along with clearly defined responsibilities and outlined processes, including how to track leads, where to store job photos, how to obtain roof measurements, etc. This also includes having company materials ready to give to the homeowner. The first few weeks can be crucial. If you have a plan in place, you can be the first roofing company in the neighborhood, maximizing your opportunities.

Sales tip #3: Prioritize high-quality leads

Having a sales tool in place that gives you accurate data on your insurance restoration leads can help you be more strategic with your time when it counts, and focus on moving the high quality ones through your pipeline faster.

Sales tip #4: Be able to create fast, accurate estimates

The ability to turn around estimates quickly helps contractors get in front of more homeowners and kick off projects faster. Be sure to have your project templates with material pricing setup. Also, having eSign and digital documents for your sales reps will help streamline the sales process and prevent multiple unnecessary trips.

Sales tip #5: Offer the homeowner financing

If you’re in a situation where a homeowner has a large deductible or requires additional work not covered by the insurance company but is crucial for their property, you can offer them competitive financing options. This is a great way to remove price-related objections.

Sales tip #6: Educate the homeowner right away

Homeowners will likely have little knowledge of the roof repair process, let alone the insurance restoration process. Your sales team needs to be able to explain what the insurance process looks like every step of the way. You can take advantage of automations to set up a series of messages that helps explain this.

Sales tip #7: Don’t neglect customer service

Meeting customer needs with high-quality work will help you earn a reputation as a trusted roofing company. One key to great customer service is providing transparency through the project. Your customer will want to feel in the loop as you deal with their insurance company. You can use a customer portal to store and share contracts, photos, messages, and invoices with homeowners.

Weather tracking apps for insurance restoration specialists

According to the National Severe Storms Laboratory (NSSL), there are around 100,000 thunderstorms in the United States each year. Ten percent of those storms can be classified as severe, with winds of at least 57.5 mph, hail of one inch or greater, or a tornado.

Weather tracking apps can help roofing contractors quickly identify areas impacted by hail and damaging winds. You can even determine the size of the hail, which can help in identifying storm damage versus general wear and tear.

Some of the best weather reporting apps include:

The pinpoint accuracy of weather tracking applications can help you determine how to best allocate your staff. If you know exactly where a storm hit and when, you can have your sales team quickly canvassing the affected neighborhoods for work rather than waiting for homeowners to call you. These tools also put you on the scene quickly and before your competition.

How to assess a roof for storm damage

Since roofing contractors that specialize in storm and hail damage typically assist homeowners in filing claims with their insurance company, you must be able to recognize the difference between a roof with standard wear and tear and a storm damaged roof. While wind (including hurricanes and tornadoes) and hail are the most common causes of roof damage, rainstorms can also lead to damage.

Steps for assessing storm damage to a roof

- Consider the type of roof you’re inspecting and what you should look for.

- Run tests while checking for damage to help confirm if the damage was from the storm.

- Share accurate and other proper documentation (aerial measurements, photos, notes, other findings, etc.) of the damage you found with the insurance company.

What to look for when inspecting a roof for storm damage

Wind Damage

It is important to know how different roof types can be affected. Shingled roofs may have cracked, curling, or missing shingles. This is due to the adhesive strip on the shingle failing and coming loose. Wood shingles may rot or become moldy. A flat roof may have cracks or surface bubbles. There can be granular accumulation in gutters or even missing or damaged gutters.

Hail Damage

When assessing damage from hail, keep in mind that hail varies from pea to grapefruit-sized. Look for dents on metal vents, gutters, shingle splits, cracks, and warping. There could be missing shingles and the gaps could form a pattern. Shingles could be damaged, curled, or buckled. Asphalt granules may also accumulate in gutters.

However, don’t assume all circular damage is from a hailstorm. Is the roof under a tree? Perhaps acorns falling off the tree caused the roof damage. Note the surroundings and consider all possibilities.

Water Damage

Identifying water damage may seem obvious, but there are still helpful signs. Again, check for cracked, curled, or missing shingles. Storm damage from water can also be evidenced by granular accumulation in gutters.

For all kinds of weather events, clear signs of roof damage may be detectable around the outside of the house, as well as on the ceiling and in the attic of the home. Therefore, it’s important to review these areas as well.

How can roofers streamline insurance restoration jobs to improve efficiency from anywhere? Download the short guidebook to learn how insurance restoration roofers can be more productive and profitable during busy seasons.

How roofing contractors can master the insurance claims process

As an insurance restoration roofing contractor, there are several ways you can master the insurance claims process, leading to better outcomes for you and your customer. These tips will help you communicate better with insurance companies and come to a mutual agreement relating to damages covered.

- Speak the language of insurance companies: Knowledge of insurance terms can help you complete all the necessary insurance restoration forms correctly. A mistake in the paperwork or skipping a step in the process will slow things down and impact your profits.

- Be willing to advocate on behalf of the homeowner: It’s not uncommon for there to be differences between your damage assessment and the adjuster’s. If this situation arises, you should negotiate on behalf of your customer, and stand by your assessment.

- Keep good records of your roof damage assessment: Many roofing contractors use mobile roofing apps, which make it easy to take and annotate photos of roof damage, while keeping notes and other critical information organized. Having your customer’s job information easily accessible enables you to share it quickly with the insurance company if they call something into question.

Roofing software designed for insurance restoration roofing contractors

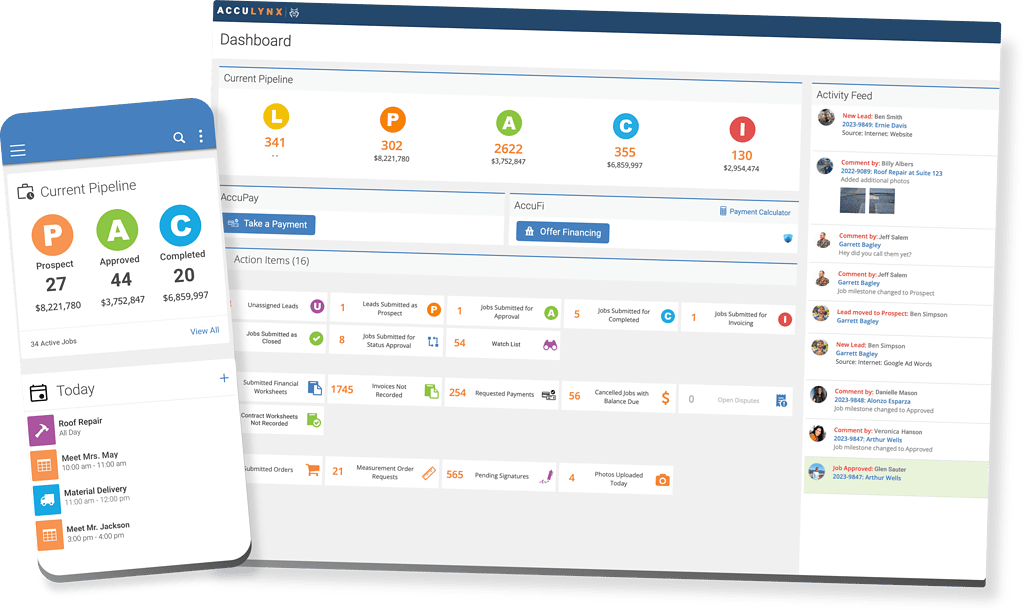

There are many moving parts when it comes to insurance restoration roofing business management. From job assignments and contracts, to tracking progress and invoicing customers, staying on top of the details is challenging without the right software. To maximize your productivity, you need to excel at project management.

AccuLynx roofing software helps you successfully manage every aspect of your business so you can serve more customers and grow. With one simple system, you can efficiently manage every aspect of the job—from sales and production, to supplementing and collections—and everything in between.

Here are a few ways AccuLynx can help roofing contractors manage their insurance restoration roofing business.

Managing roofing paperwork

AccuLynx offers document management tools such as Smart(er) Docs and eSign. These two features help improve efficiency and maximize sales. Smart(er) Docs automatically populates the same information across all documentation in a job file. This time-savings means an insurance contractor’s sales teams can move quicker and canvass greater areas, instead of wasting time filling out repetitive paperwork. In addition, the eSign feature means documents can be electronically signed quickly and easily, reducing time spent tracking down signatures.

Improving accuracy

AccuLynx integrates with EagleView and GAF QuickMeasure, allowing you to order accurate aerial measurements right from the software. Measurement reports automatically populate an estimate, eliminating the need for double data entry and reducing errors. AccuLynx also stores your aerial measurement reports in the specific customer job file, keeping everything together. These features save you time so you can cover more ground and send estimates to homeowners quickly.

Get your job done from anywhere

The AccuLynx mobile roofing app enables you to take AccuLynx wherever you go. Whether you need to review your schedule or access job information, this mobile app helps you stay productive on the go, including:

- Entering leads, updating job files, and logging activities

- Annotating and sharing photos

- Sending estimates on the spot

- Capturing digital signatures

- Ordering aerial roof measurements

- Contacting customers right from the app

The AccuLynx Field App keeps roofing contractors connected to the home office, so everyone always knows who’s doing what.

Communicating with crews

The mobile Crew App helps roofing contractors manage their crews more effectively and ensure jobs are progressing on track. With the mobile Crew App, crews are instantly notified of their assignments and have access to all the information they need to complete a job, including start date, jobsite address, points of contact, labor instructions, photos, associated documents, and more.

The app improves communication through checklists and English/Spanish translations, allowing production managers to stay updated in real-time without having to be at the job site.

Understanding performance

AccuLynx has a comprehensive suite of reporting features that help roofing contractors understand performance, make better decisions, and drive business ahead. For example, you can customize pre-built dashboards to show metrics you want to keep an eye on and have reports delivered to your inbox on a regular basis. These reporting tools are essential to keeping your insurance restoration business on track.

Take your insurance restoration roofing business from a startup to a success

Building a successful insurance restoration roofing business is within reach if you have well-established processes, reliable people on your team, and a business management system that brings your company together. AccuLynx is the roofing industry’s most-trusted software, designed to help insurance restoration contractors manage and grow their business. Find out why thousands of contractors use AccuLynx every day to run their operations. Get a live demonstration today.