For roofing contractors in states like Florida, Texas, and the Carolinas, hurricane season brings more than bad weather. It also creates challenges with insurance claims.

As a contractor, you need to understand the nuances of hurricane deductibles in order to effectively guide your customers through the insurance process. Hurricane deductibles, sometimes called named storm deductibles, are separate from standard home insurance deductibles. They determine how much homeowners will pay for repairs caused by hurricanes. Knowing how these deductibles impact your bids and the claims process helps you provide accurate estimates and simplifies the experience for you and your customers.

In this blog, we’ll explore:

- The difference between standard and hurricane deductibles

- How contractors help homeowners manage claims

- Insurance deductible management with AccuLynx

- Navigating hurricane season with AccuLynx

The difference between standard and hurricane deductibles

Hurricane deductibles are different from standard insurance policies because they’re calculated as a percentage of the home’s insured value. They typically range from 1% to 5%.

For example, if a home is insured for $300,000 and has a 2% hurricane deductible, the homeowner would need to pay $6,000 out of pocket before their insurance coverage applies. This can lead to significant costs for homeowners, depending on their policy.

Hurricane deductibles are only triggered when the damage is caused by an officially declared hurricane. Storms that don’t meet this threshold may fall under a standard deductible. State-specific regulations determine how and when these deductibles apply, and they are required in 19 states. While hurricane deductibles can sometimes lower insurance premiums, they usually result in higher out-of-pocket expenses after a hurricane.

For roofing contractors in high-risk areas, understanding these deductibles and their impact on homeowners’ coverage is essential.

For more information on your state’s hurricane deductible policies, visit your Department of Insurance website.

How contractors help homeowners manage claims

Hurricane deductibles force homeowners to pay more out of pocket before their insurance covers the rest. This can create financial strain and cause delays in the repair process as homeowners may need time to come up with funds. As a roofing contractor, this means you might have to wait longer to get paid since the work usually can’t begin until those costs are covered.

However, you can help prevent these delays by addressing the issues upfront.

Educating homeowners on hurricane deductibles

Many homeowners lack a clear understanding of hurricane deductibles, even if they have one. As a roofing contractor, you can help educate them. This way, they will understand their financial responsibilities better.

- Explain the difference between their policies: Help homeowners understand that hurricane deductibles are usually higher. They are calculated as a percentage of the home’s insured value.

- Clarify costs and timelines: Clearly communicate how hurricane deductibles influence repair costs and project start times. By ensuring homeowners are aware of these costs upfront, you can help prevent delays and keep the project on track.

When you take the time to educate homeowners early on, it sets clear expectations and makes the whole project run more smoothly.

Streamlining the insurance claims process

In addition to educating homeowners, you also need to assist them with the insurance claim process. Your expertise is vital for documenting damage, providing accurate estimates, and helping homeowners navigate their claims effectively. Here’s how to streamline this process:

- Keep clear records: Detailed documentation and open communication with insurance adjusters and homeowners can speed up approvals and reduce delays.

- Prepare itemized estimates: When assessing damages, create itemized estimates that reflect hurricane-specific repairs. This ensures that all necessary work is accounted for and justifies the costs to insurance adjusters.

- Coordinate financial responsibilities: Work closely with homeowners to incorporate deductible amounts into the total repair costs. This helps set realistic financial expectations, allowing for better planning and a smoother claims process.

By following these practices, roofing contractors can take some of the stress out of the claims process.

Insurance deductible management with AccuLynx

AccuLynx provides roofing contractors with all of the essential tools to streamline the management of insurance claims.

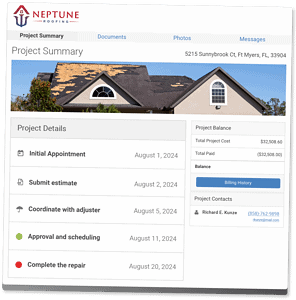

Centralized document and photo storage

AccuLynx lets you store and manage all important job documents in one place. This includes damage photos, estimates, and the homeowner’s insurance report. For instance, you can add annotated storm damage photos directly to your estimate. This makes the claim submission and approval process easier.

Real-time communication tools

AccuLynx improves communication between contractors, homeowners, and insurance adjusters.

- With the Customer Portal, you can keep homeowners informed about the status of their claim, deductible amounts, and any additional repairs that may arise.

- Text messaging makes it easier to stay connected with both customers and team members, all within the same system you use to manage your business. This streamlined communication helps track all interactions, creating a clear timeline and reducing delays caused by scattered communication.

More accurate estimates

By using customizable templates in AccuLynx, you can quickly create accurate estimates and add a specific line item for the hurricane deductible. This ensures homeowners understand their financial responsibilities upfront, eliminating confusion and improving transparency.

AccuLynx also streamlines the estimation process by integrating with aerial measurement tools and material suppliers, giving you access to precise measurements and real-time material costs. With these automated features, you’ll capture every detail, reducing the risk of errors and unexpected costs.

Providing homeowners with clear, detailed estimates not only builds trust but also keeps projects on track.

Tracking payments and progress

AccuLynx enables contractors to monitor payments, including partial payments, which is crucial for keeping projects on schedule. Contractors can set up progress billing to reduce large upfront costs for homeowners and offer financing options for the remaining project expenses, ensuring your cash flow remains steady throughout the project.

Navigating hurricane season with AccuLynx

Being prepared during hurricane season is important for roofing contractors and homeowners alike. AccuLynx equips roofing companies with essential features like lead vetting, tracking, and job scheduling. With these project management tools, they can stay organized during busy season, respond to homeowner needs, and manage complex insurance claims.

Book a demo and learn how leveraging AccuLynx’s capabilities can boost customer service and build trust with homeowners during the critical hurricane season.