At the beginning of 2025, the Pacific Palisades were engulfed in flames for 24 days—just the latest blow in California’s home insurance crisis. Even before rebuilding began, homeowners across the state were already grappling with policy non-renewals, major carriers pulling out, and skyrocketing premiums.

For roofing contractors, this crisis has had a ripple effect. Homeowners are under increased pressure to maintain their insurance with scarce options. They’re looking for faster, more frequent roof inspections, stricter documentation, and closer collaboration between contractors and insurance carriers in order to keep their homes covered. While contractors can’t control the insurance market, they can control how prepared their business is to meet these rising demands.

To help you navigate these challenges, this blog will cover everything you need to know regarding the ongoing home insurance crisis in California—and how AccuLynx’s roofing software offers critical support.

In this blog we’ll cover:

- Why is there a home insurance crisis in California?

- Policy changes

- Impact on roofing contractors

- How AccuLynx supports contractors in insurance restoration

Why is there a home insurance crisis in California?

The California home insurance crisis is the result of overlapping pressure that has been building for years:

Rising wildfire risks

Frequent, severe wildfires have made many parts of California among the riskiest in the nation to insure. These fires are caused by years of land management choices, like deprioritizing forest thinning and controlled fires.

Inflation and reconstruction costs

Ongoing inflation pressures have led to material and labor price hikes that have resulted in claims being more expensive to settle. With higher average claims, insurers attempt to pass these costs down through rising premiums.

Proposition 103 restrictions

This 1988 law requires the California Department of Insurance to give approval before insurers can raise rates. While designed to protect consumers from rate hikes, critics argue the proposition prevents insurers from pricing risk accurately, painting an inaccurate picture of residency in California, and driving many carriers out of the state to protect their financial standing. This concept is known as creating a moral hazard.

Historic modeling vs catastrophe modeling

For the first time, California is proposing that insurers can use catastrophe models that include climate change when setting rates. Previously, insurers relied only on historic losses, which underestimated future damages and ignored residents’ wildfire prevention efforts. This often led to higher premiums during wildfire spikes.

Reinsurance pressures

Reinsurance is like insurance for insurance companies—it helps them spread out risk. In California, higher risks mean higher reinsurance costs. Normally, these costs would be passed to customers through higher premiums, but Proposition 103 often limits rate increases, leaving insurers to absorb the extra expense.

Recent California policy changes

The breaking point came in 2023, when California’s largest homeowners insurer, State Farm, announced it would stop writing new policies. Other carriers soon followed.

California FAIR Plan

As more insurers pull out of California, the burden has shifted to the California FAIR Plan. By 2023, its coverage exposure had grown to over $300 billion, well beyond what it was designed to handle.

The FAIR Plan serves as the state’s insurer of last resort, offering coverage to homeowners who can’t get traditional policies because their properties are considered too high-risk for fire. It’s meant to be a temporary safety net until other coverage becomes available.

Meanwhile, insurers still operating in California are relying heavily on aerial imagery to assess property risk. While useful for carriers, this approach has led to non-renewals for homeowners flagged for roof wear, moss, or algae. In many cases, the aerial images have proven inaccurate—either too grainy to show the real condition of a roof or even capturing the wrong house altogether.

Bill 75

California policymakers have responded with proposals like Bill 75, which would limit insurers’ ability to use outdated aerial imagery, require notice before imagining a property, and give homeowners the right to access their images. Even so, one thing is clear: homeowners will need frequent, documented roof inspections to protect their coverage.

Impact on roofing contractors

California’s home insurance crisis is forcing roofing contractors to adapt to new challenges while finding opportunities to stand out. Rising non-renewals, stricter insurer requirements, and growing homeowner demand all play a role.

Inspections & documentation

With non-renewals on the rise, homeowners are depending on ground-level roof inspections and detailed records to contest insurer decisions. Contractors need efficient systems to track inspections, insurer communications, and supplements. The best practice is to schedule proactive assessments, capture high-quality images and measurements, and store everything in organized digital files. Compliance-ready reports not only speed insurer approvals, but also build trust with homeowners who are relying on contractors to safeguard their coverage.

Growing homeowner demand

Homeowners worried about keeping insurance are investing more in roof repairs and replacements. Contractors who can effectively track leads—and communicate clearly with homeowners—will be best positioned to capture this demand. Word-of-mouth referrals carry extra weight, as homeowners turn to trusted contractors to help them navigate insurer requirements.

Payments & costs

Insurance-driven work often comes with slower or more complex payouts, while rising material and labor costs continue to squeeze margins. Contractors that stay on top of job tracking, cash flow, and supplier spend will be better prepared to negotiate pricing, create accurate estimates, and maintain profitability during busy seasons.

How AccuLynx supports contractors in insurance restoration

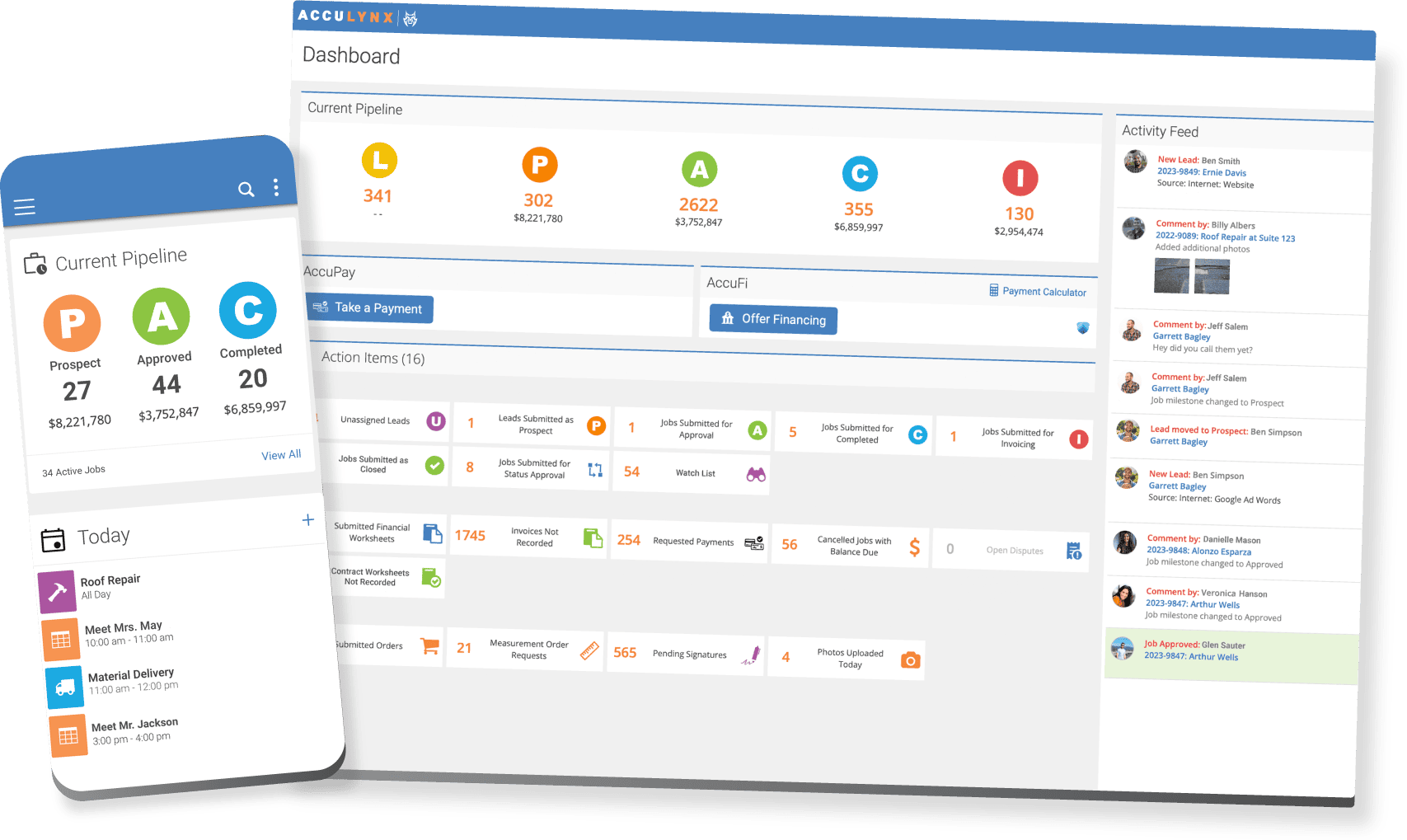

California’s insurance challenges are driving more inspections, higher homeowner demand, and tighter documentation requirements. AccuLynx helps roofing contractors adapt with tools designed to streamline processes, improve communication, and protect profitability.

Document & perform digital inspections

Non-renewals often hinge on detailed roof inspections. With AccuLynx, contractors can capture unlimited photos and videos through the Field App, add markups, organize albums, and share links with homeowners or insurers. Integrations with apps like CompanyCam and aerial measurement providers ensure high-quality evidence, all synced automatically to one job file. This creates compliance-ready documentation that speeds insurer approvals and gives homeowners peace of mind.

Standardize communication & visibility

Clear communication builds trust in a time when coverage is uncertain. AccuLynx’s Customer Portal keeps homeowners updated on project progress through a branded interface, while the Mobile Crew App equips field teams with job details, check-in/out, instructions, and photo sharing. Together, these tools ensure transparency across contractors, homeowners, and insurers.

Streamline material ordering & cost control

With integrations to ABC Supply, SRS Distribution, and QXO, AccuLynx lets contractors check real-time pricing and availability, place orders directly to their preferred branch, and track statuses without leaving the platform. ReportsPlus adds visibility into supplier spend, empowering contractors to negotiate better pricing and protect margins.

Simplify payments & financial tracking

Insurance-related jobs often mean slower payouts. AccuLynx helps contractors keep cash flow moving with built-in invoicing, payment processing (credit, debit, ACH), and financing options. Integrations with QuickBooks and Sage Intacct eliminate double data entry, giving contractors tighter control over job-level financials.

Scale with demand using a roofing-first CRM

As homeowner demand rises, AccuLynx provides the operational infrastructure contractors need to grow. Features like drag-and-drop scheduling, automated notifications, custom workflows, proposal templates, and pre-built dashboards give contractors real-time insights to manage more jobs efficiently—without sacrificing profitability.

All of these tools help you stay agile during surges of restoration demand and manage increased insurer demands from prospects, without overwhelming your operations.

Roofing software won’t solve the insurance crisis, but it can help contractors navigate it. AccuLynx gives California contractors the tools to navigate today’s insurance challenges while protecting margins and winning more jobs. See how AccuLynx can help your business, request a demo today.