The U.S. residential solar market size was estimated at $7.45 billion in 2023 and is expected to grow 14.4% by 2030. Installing solar panels or other solar equipment is becoming an increasingly popular roofing choice, with 35% of homeowners expressing interest in solar roofing materials.

As interest in incentives for solar panels grows, it’s vital for your roofing company to understand and help homeowners navigate this market, including the incentives and rebates available. By increasing your knowledge of these financial incentives, you can serve your customers more effectively, add value to your roofing business, and ultimately, close more deals.

In this blog, we’ll discuss,

- Types of incentives for solar panels available in 2025

- Challenges for contractors managing incentives for solar panels

- How AccuLynx simplifies solar projects for roofing contractors

Types of incentives for solar panels available in 2025

To encourage the production of green energy, national, state, and local governments have made many incentives for solar panels available to homeowners. As a roofing contractor, you can guide homeowners through major incentives, showcasing your expertise and adding value to your services.

Federal tax credits

The federal government offers an investment tax credit, or ITC, for residential solar panel installation. Under the ITC, residential solar systems installed between 2022 and 2034 are eligible for a 30% federal tax credit . This tax credit covers solar panel costs, installation costs, equipment, and energy storage devices, and there is no maximum amount that can be claimed.

State-level solar panel rebates

In addition to federal tax credits, many states offer solar panel rebates and other incentives for solar installation. Here are some of the leading state-level solar incentives:

-

Texas solar incentives:

In Texas, the value of solar panels and batteries is excluded when home values are assessed for property tax, so Texans can add solar equipment to their home without increasing their tax burden.

-

Florida solar incentives:

Just like Texas, Florida excludes the value of solar panels and batteries from the assessment of property tax. Solar energy systems are also exempt from sales and use tax in Florida. In addition, Floridians can apply for state loans to help pay for solar equipment, and receive money back for excess solar energy generated.

-

Illinois solar incentives:

Illinois offers renewable energy credits so homeowners can earn money from the electricity generated from their solar panels. Low-income Illinois residents can also get solar panels installed for no upfront cost.

Local utility incentives

On a local level, many utility companies offer incentives for solar usage to their customers. These may include:

-

Net metering:

Homeowners can receive credits for energy produced by their solar panels which they don’t use, allowing them to save money on their utility bills.

-

Solar renewable energy credits (SRECs):

Homeowners earn credits based on the kilowatt-hours of energy they generate, which can then be sold to utility companies.

Learning more about the solar incentives offered in your area and staying up to date on policy changes will give you the information you need to help homeowners navigate the solar market.

Challenges for contractors managing incentives for solar panels

While the growing number of solar panel rebates and incentives is beneficial for homeowners, managing these opportunities can be challenging for roofing contractors. Here are a few of the biggest challenges that contractors can face when dealing with solar incentives:

-

Juggling deadlines and paperwork:

To take advantage of solar incentives, you and your homeowners need to stay on top of multiple deadlines and make sure the appropriate paperwork is filled out accurately. Multiply this across many incentives and customers, and it can become a daunting process.

-

Incorporating incentives and rebates into estimates and contracts:

Depending on how you create your estimates and contracts, incorporating the incentives and rebates can take up significant time and add complexity to the process.

-

Providing homeowners with accurate information:

Solar panel rebates and incentives change frequently, and staying on top of these changes so you can keep homeowners informed is often difficult, especially while also managing a busy roofing business.

-

Keeping projects on schedule:

Roofing jobs have a lot of moving parts, and managing solar incentives in addition to the other aspects of a roofing job can sometimes lead to delays or customer dissatisfaction.

How AccuLynx simplifies solar projects for roofing contractors

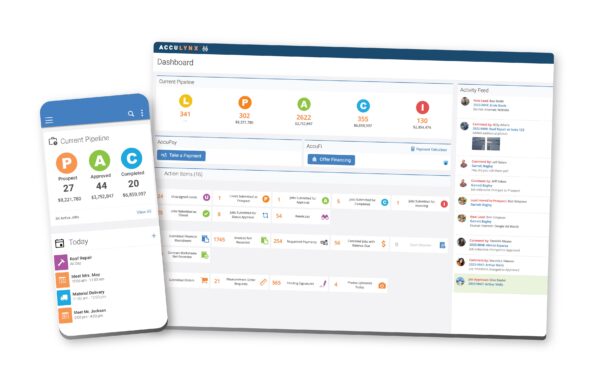

Despite the challenges, AccuLynx provides tools to streamline the process of managing solar panel rebates and other incentives. Here are a few ways that our software can help make your solar projects run more smoothly.

Tracking incentive deadlines

AccuLynx task management tools can help your roofing business stay on top of incentive deadlines more easily. Use the Workflow Manager in AccuLynx to identify every step of a solar project, including submitting permits, structural certifications, and compliance documents, ensuring an efficient and hassle-free process for contractors and homeowners. You can also use the Automation Manager in AccuLynx to create automated tasks that are triggered when a new solar job is approved in AccuLynx, so you’ll never miss a deadline.

Incorporating incentives into estimates

AccuLynx makes it simple to build and customize estimates with tools that let you easily adjust line items as needed. Once you’ve created an estimate that includes specific solar incentives, you can save it as a reusable template. Additionally, you can create standout roofing proposals in AccuLynx that highlight the potential financial savings from these incentives, with the option to save these pages as templates for quick and professional proposal creation.

Streamlining contracts and documentation

The digital document management tools in AccuLynx take the complication out of managing contracts and other documentation. With just a few clicks, you can turn any estimate into a professional-looking contract that clearly outlines the rebates and incentives, then send the contract to your customers for electronic signature.

AccuLynx makes it easy to keep homeowners informed about their projects, including updates on solar incentives. Through the Customer Portal, homeowners can track project progress in real time, giving them visibility into every stage—including solar-related updates—which provides greater transparency and trust between you and your customers.

Adding value to your roofing business with solar expertise

Homeowners often turn to roofing contractors for advice on solar panel incentives and installation options. By staying up-to-date on local and national solar rebates, you can establish yourself as a trusted expert. This knowledge helps you overcome pricing objections and close more deals. Including this information in your sales pitches highlights the financial benefits of solar incentives and helps address pricing concerns. Positioning yourself as a solar expert will differentiate your roofing business, attract customers interested in solar energy, and ultimately help you secure more jobs.

Stay ahead with AccuLynx and solar incentives

Mastering solar panel rebates and incentives can bring new business to your roofing company while helping homeowners save money. AccuLynx makes navigating incentives seamless by giving you the tools to stay on top of deadlines, communicate with customers, and incorporate solar incentives into your sales process. To learn more about how AccuLynx can simplify solar projects, see a custom demo today.